Evaluating the Rental Health of REITs

Introduction

In this article, we will use FrontView REIT as an example to highlight key areas related to rental income. While we focus solely on rental aspects here, it's important to remember that when evaluating REITs, other critical factors such as debt, operational efficiency, equity structure (common and preferred), and financial leverage should also be considered. This article will specifically cover the measures crucial for assessing the rental strength of a REIT, with insights drawn from FrontView REIT's 10-Q report.

What is Meant by Rental Health for a REIT?

Rental health refers to the overall condition and sustainability of a REIT's rental income. It encompasses various factors that influence the stability and growth potential of the rental revenues generated from the properties in the REIT’s portfolio. A strong rental health indicates that the REIT has a reliable stream of income from its tenants, which is essential for generating consistent dividends and maintaining property values.

Key Measures to Evaluate the Rental Health of a REIT

When evaluating the rental health of a REIT, investors should consider several key metrics.

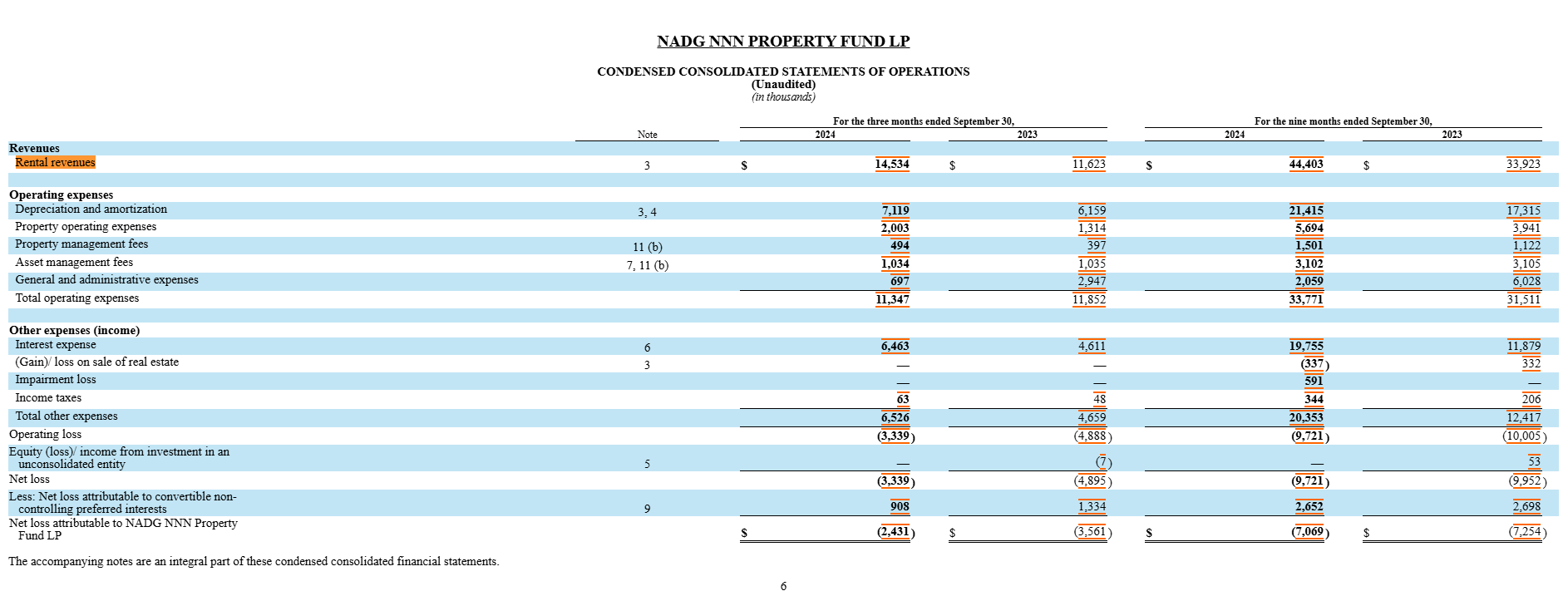

1. Rental Income Growth Over Time

A critical measure of rental health is the growth of rental income over time. Investors should look for consistent and sustainable growth rates in rental income. Steady growth indicates a well-managed portfolio, with properties that are likely to generate reliable revenue. On the other hand, stagnant or declining rental income may suggest operational challenges, poor tenant retention, or issues with property management. By assessing historical growth trends, investors can gauge the REIT’s potential for future income growth, making it a crucial indicator of rental health.

The image below displays an extract from the 10-Q SEC filing by FrontView REIT, highlighting the change in rental revenue. This extract is located under Item 1 in the Condensed Consolidated Statements of Operations (Unaudited) section of the filing.

2. Occupancy Rates

Occupancy rates are among the most fundamental indicators of a REIT's rental health. Occupancy rate refers to the percentage of rented space relative to the total available space within a property or portfolio of properties. A higher occupancy rate typically signals stronger demand for the REIT’s assets, leading to a more reliable stream of rental income. Conversely, low occupancy rates may indicate issues with property appeal, tenant retention, or market conditions.

To assess a REIT’s occupancy rate, investors should consider:

- Historical occupancy rates: How does the current rate compare to past performance? A consistent or improving rate suggests strong rental health.

- Market comparison: How does the REIT’s occupancy rate compare to industry averages or peers in the same market? A rate above the market average indicates stronger performance.

- Occupancy by individual property: Investors should review occupancy rates for individual properties, especially large or material assets, as these significantly impact the REIT’s overall performance.

The image below shows an excerpt from FrontView REIT's 10-Q SEC filing, which provides details on the occupancy rate. This information can be found in Item 2: Real Estate Portfolio Information.

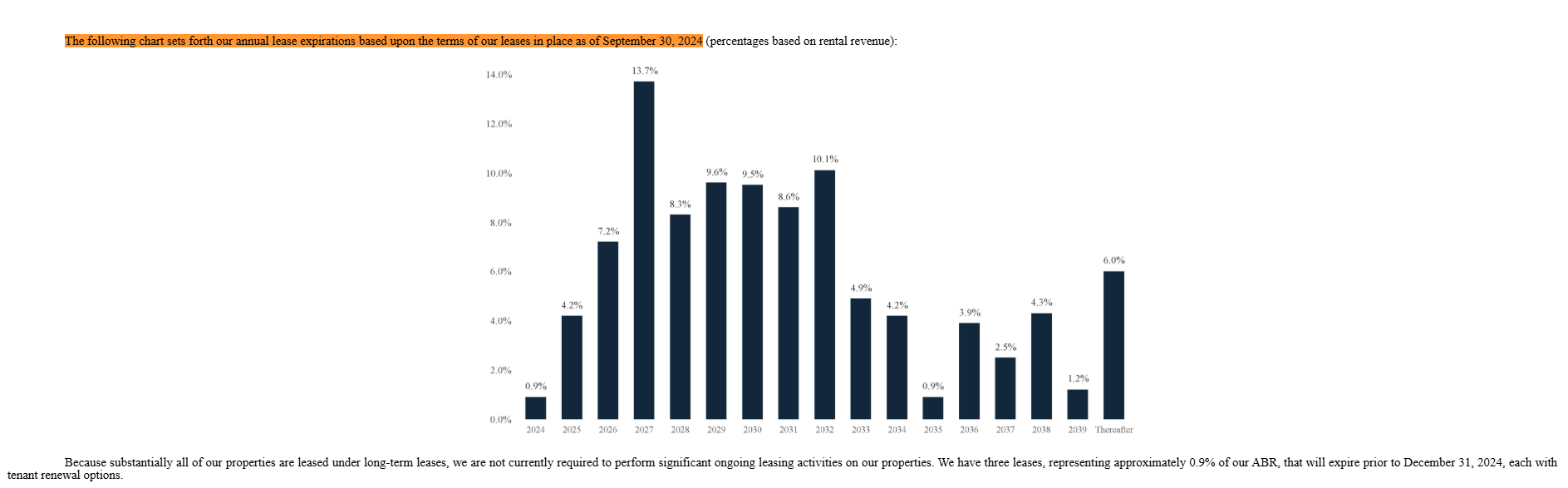

3. Lease Terms

The structure of a REIT’s leases plays a significant role in determining its rental health. Long-term leases with built-in rent escalations offer stability and ensure that the REIT can expect predictable rental income over time. In addition, the tenant diversification within the portfolio can reduce risk, as the REIT is not overly reliant on a few tenants. The image below displays an excerpt from FrontView REIT's 10-Q SEC filing, highlighting the annual lease expirations. This extract can be found in Item 2: Real Estate Portfolio Information.

4. Rental Reversion

Rental reversion is another critical metric that measures whether newly signed leases are entered at higher or lower rental rates compared to previous leases. A positive rental reversion, where new leases are signed at higher rates, is a sign of a strong rental market and indicates a potential for higher earnings. Conversely, a negative rental reversion, where new leases are signed at lower rates, could signal a weakening market or declining property values.

Investors should focus on positive rental reversion, as it indicates a growing rental income base, which is vital for the REIT’s overall rental health.

5. Tenant Concentration

Tenant concentration refers to the extent to which a REIT’s rental income depends on a small number of large tenants. High tenant concentration poses a risk because the loss of a single major tenant can significantly impact the REIT’s rental income. Investors should assess the diversity of the REIT’s tenant base to determine whether it is overly reliant on a few key tenants. A more diversified tenant base generally results in greater rental stability and lower risk.

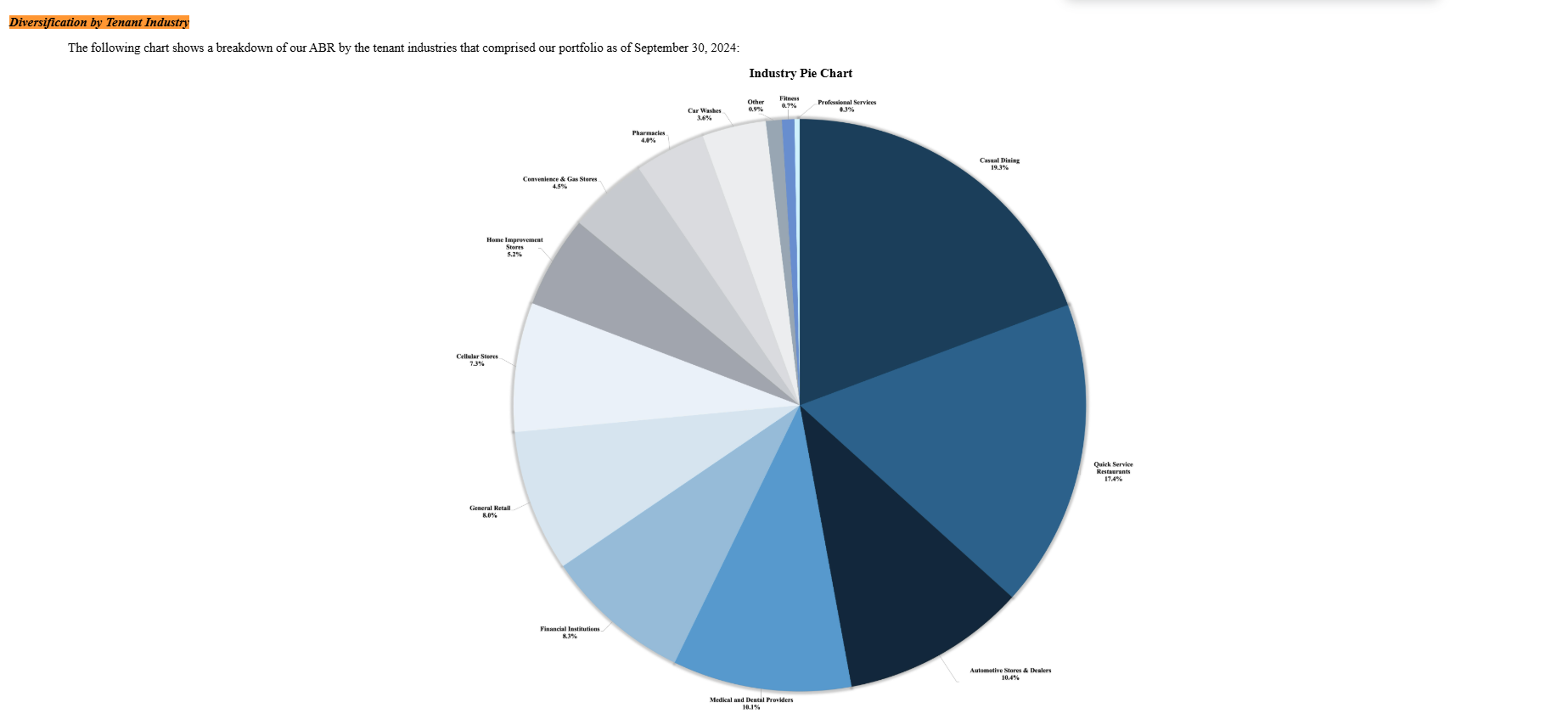

6. Industry Concentration

Similar to tenant concentration, industry concentration refers to the REIT’s dependence on income from tenants in a specific industry. If a REIT derives most of its rental income from tenants in one particular sector, such as retail or hospitality, it may be vulnerable to industry-specific downturns. To evaluate rental health, investors should look at how diversified the REIT’s tenant industries are and ensure that its portfolio is not overly reliant on one sector.

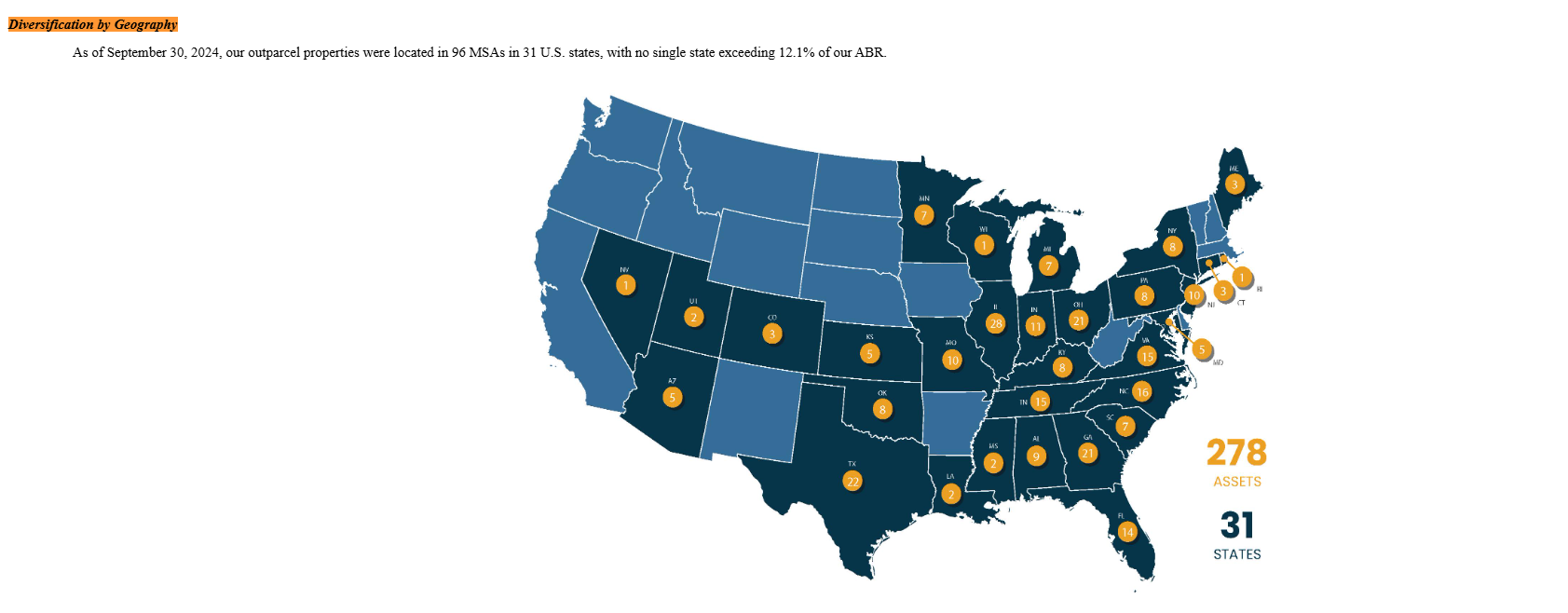

The image below shows an extract from FrontView REIT's 10-Q SEC filing, highlighting its diversification by tenant industry and geography. This information can be found in Item 2: Real Estate Portfolio Information.

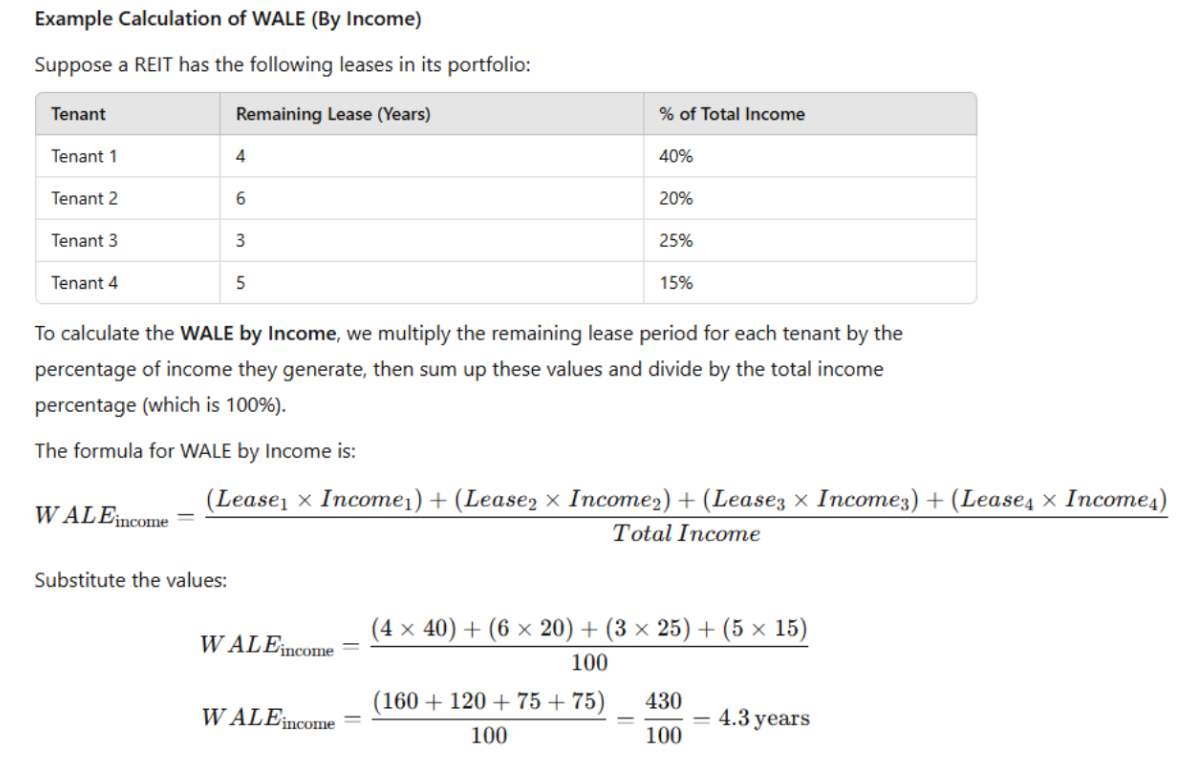

7. Weighted Average Lease Expiry (WALE)

WALE is a measure of the average time period in years when all the committed leases in a REIT’s portfolio will expire. A longer WALE provides stability, as it means that a greater proportion of the REIT’s rental income is locked in for a longer period. For example, FrontView REIT has a remaining lease term of approximately 7 years, indicating that a significant portion of its rental income is secured over the long term, which reduces the risk of sudden income fluctuations. A shorter WALE may indicate a higher turnover of tenants and increased vacancy risk. Investors should consider the WALE when assessing a REIT’s rental health, as it provides insights into how long the REIT can expect its current rental income to remain intact.

Example Calculation of WALE:

The WALE by Income for this REIT portfolio is 4.3 years, which means that, on average, the REIT’s rental income is secured for 4.3 years before leases start to expire.

Conclusion

Evaluating the rental health of a REIT is crucial for investors seeking to understand its income potential and stability. By assessing key metrics such as rental income growth, occupancy rates, lease terms, rental reversion, tenant and industry concentration, and WALE, investors can make informed decisions about the sustainability and future prospects of a REIT. These measures provide insights into the REIT’s ability to generate consistent and growing rental income, which is fundamental for maintaining strong performance and delivering attractive returns to investors.